Snippet

Amazon’s new parapharmacy in Milan is an intriguing experiment, blending retail and technology. However, the digital integration feels incomplete, with limited benefits for Prime users. The real strategy seems to focus on online expansion rather than revolutionizing the in-store experience.

Amazon Parapharmacy: between media hype and an experience that raises doubts

This morning, I visited Amazon’s new parapharmacy in Milan, an opening that has generated significant media attention. I couldn’t miss the chance to see firsthand this phygital experiment by a global giant in a crucial sector like health and wellness. However, the initial excitement soon gave way to a certain disappointment.

Phygital, but with little digital

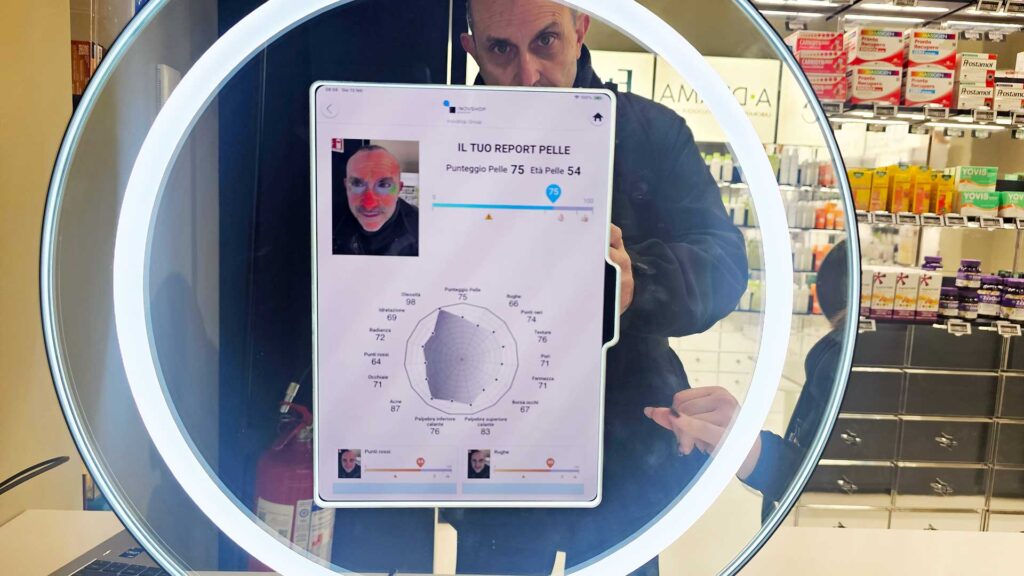

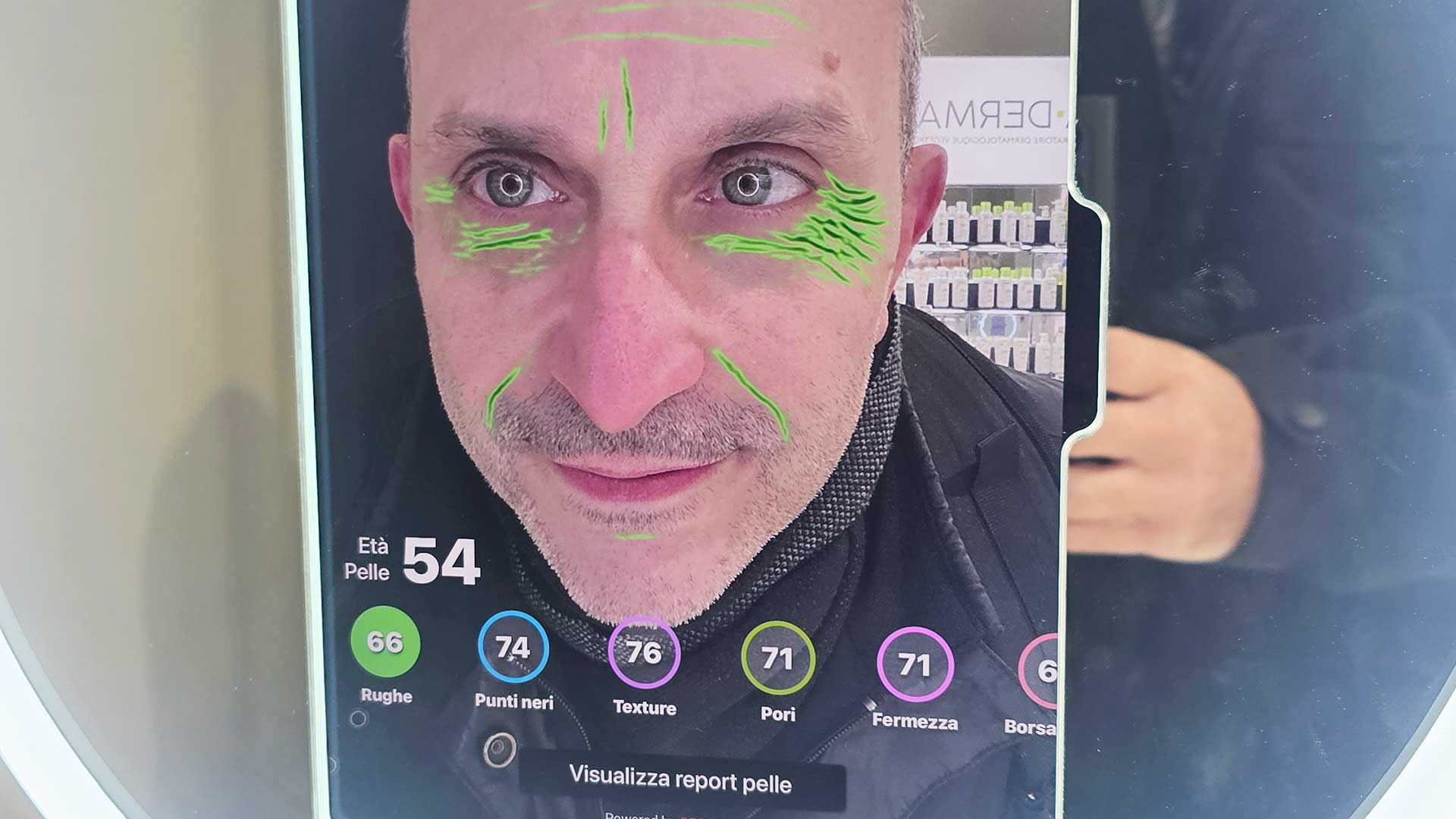

The much-publicized integration between physical and digital seems, in reality, still immature. The only technology-driven experience is the skin analysis service, which could represent an interesting touchpoint between retail and innovation. However, the test results cannot be synchronized with an Amazon Prime account or stored digitally; the only option is to take a photo of the machine’s screen. A user experience that feels underwhelming compared to the standards Amazon has accustomed us to.

A dermatological test that feels more like a sales pitch than a consultation

The skin analysis, which should be the flagship in-store experience, is so quick that it feels rushed. Despite being the only customer in the store early in the morning, the test lasted only a few seconds, assigning me a skin age of 54 years (I am 52). The doctor, kind and helpful, explained the results to me, but it felt like everything was structured to lead me toward purchasing the right product. I pointed out that I had just gotten off my motorcycle after 30 minutes in the cold, which could have affected the test. She confirmed that skin temperature influences the results, but the system doesn’t seem to account for external factors.

More of a flagship store than a functional shop

Beyond the skin analysis service, the product offering is limited to over-the-counter medications and beauty products, without any distinctive elements compared to a traditional parapharmacy. It feels more like a flagship store aimed at building brand awareness than offering real retail innovation. Furthermore, the prices are not aligned with those on Amazon’s marketplace, and there are no exclusive benefits for Prime customers. Even the ability to pick up online purchases in-store, which could have been an excellent opportunity to integrate physical and digital experiences, has not been implemented.

Amazon and beauty: an experiment focused on online expansion

Analyzing this operation from a marketing perspective, several key elements emerge. Amazon does not seem particularly interested in direct sales through the physical store but rather in building an ecosystem of brands and products that it can later push more aggressively on its marketplace. The beauty and dermocosmetics sectors have high added value and are strongly tied to consumer trust. A physical store allows Amazon to test the market, strengthen partnerships with premium brands, and gather valuable insights into shopping habits.

Notably, Giorgio Busnelli, Amazon’s Vice President of Consumer Goods Categories in Europe, stated that no further similar openings are planned in Europe but that the product selection will be available online in 2025 for markets in Germany, France, Spain, and the United Kingdom. The real goal, then, seems to be creating a physical showcase to position Amazon as an authoritative player in the beauty segment, leveraging this credibility at a digital level.

Pharmacy retail and omnichannel strategies: who should be concerned?

If pharmacies can breathe a sigh of relief—Amazon does not seem interested in competing directly in the non-prescription drug market—the situation changes for the dermocosmetic industry. Here, the Seattle giant is constructing an omnichannel strategy that could prove disruptive: creating a complete catalog, building consumer trust through physical experiences, and then scaling the model through e-commerce.

The key element of this operation is marketing potential and brand positioning rather than the purchasing experience itself. For now, the Milan store presents itself as a hybrid experiment—interesting but still lacking impact. Amazon has accustomed us to far more disruptive revolutions; time will tell if and how this concept will evolve.

Milan, always at the forefront of innovation testing

It is still significant that Milan was chosen for Amazon’s first physical foray into the parapharmaceutical sector. A city that has always embraced experimentation and, with its industrious nature and openness to change, continues to be a strategic hub for new retail trends.

Amazon has shone a spotlight on a market segment with great potential, but it seems that the real transformation will come more from online initiatives than from the in-store experience.

The future will reveal whether this first step marks the beginning of a new revolution or just a standalone experiment in the e-commerce giant’s strategy.